System

OVRC itself.

OVRC (Overseer Control)

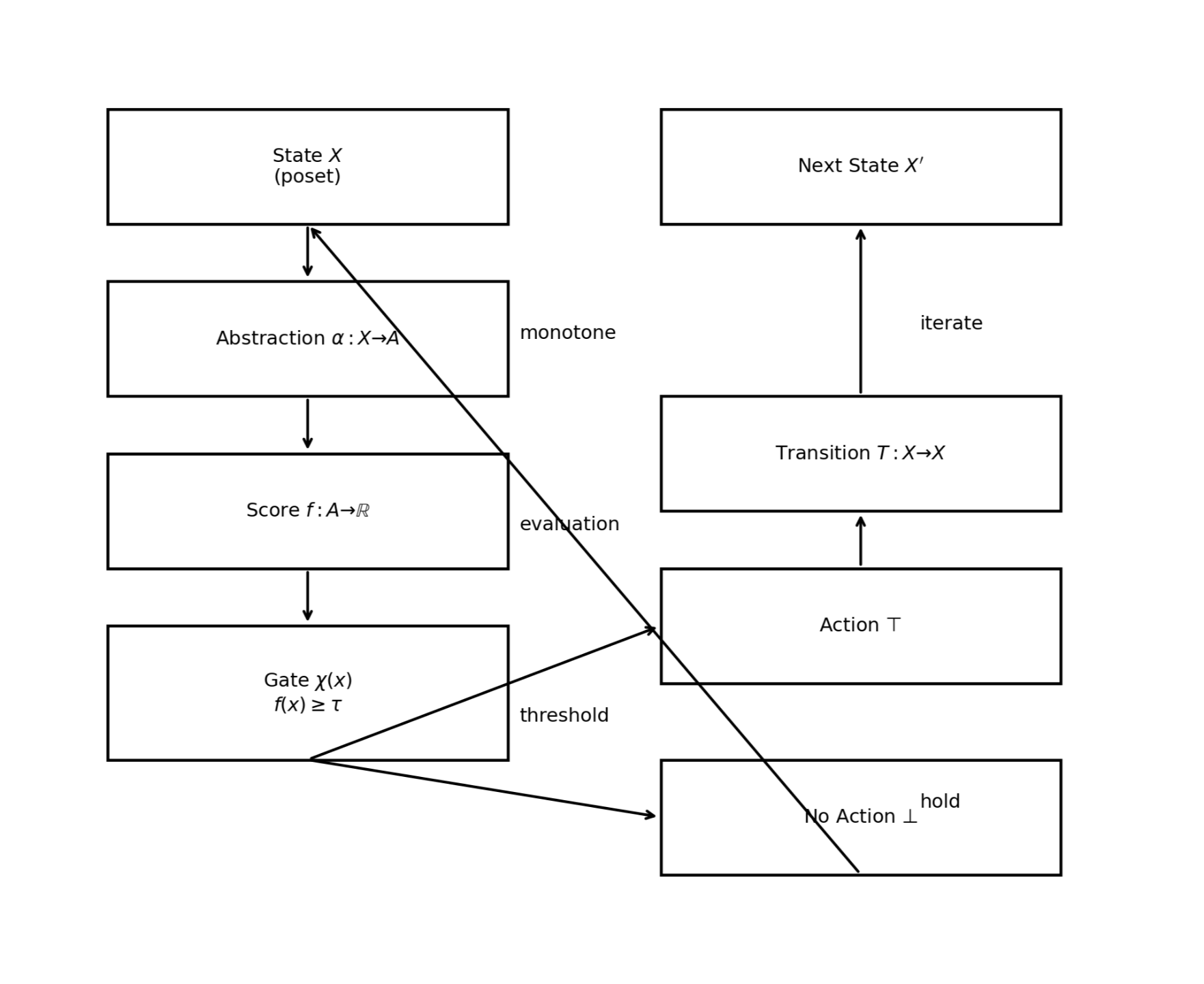

A supervisory gate. The governor enforces admissibility.

ACT (Action Policy)

Proposes an action.

Axis (Representation)

A mapping from raw state to coordinate system.

Circular Dynamics

Defines how signals, memory, and control relate before any data enters.

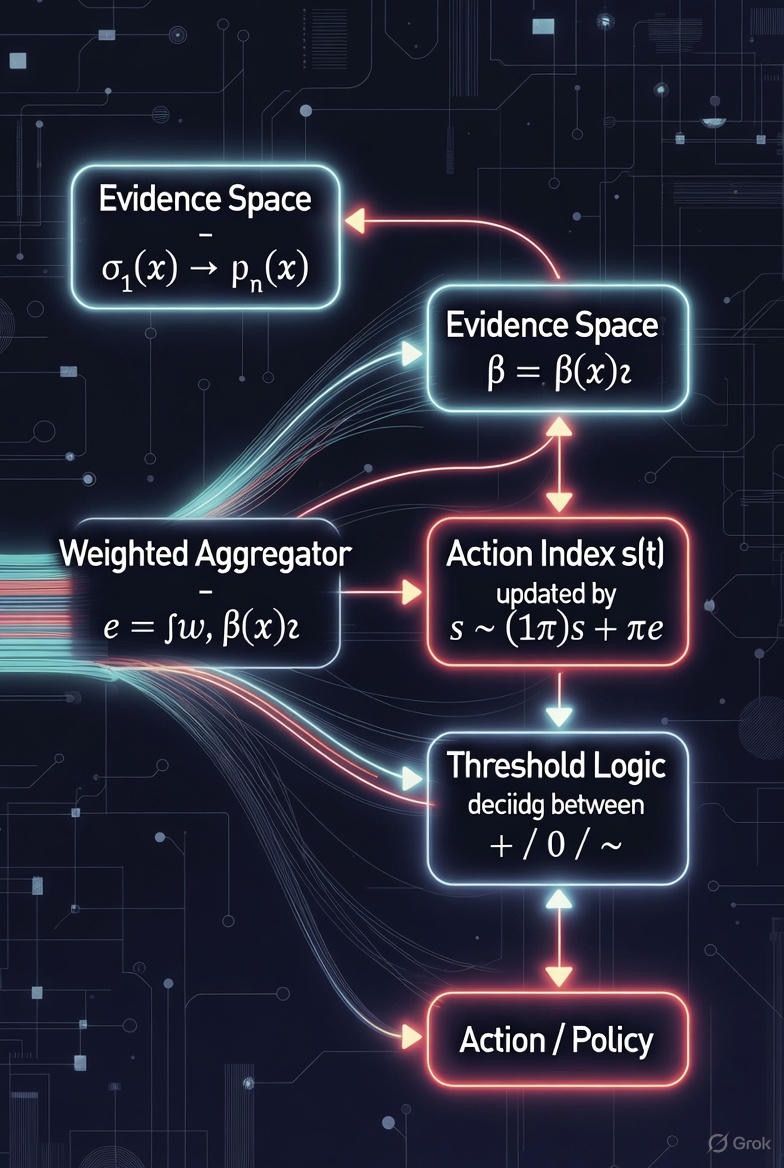

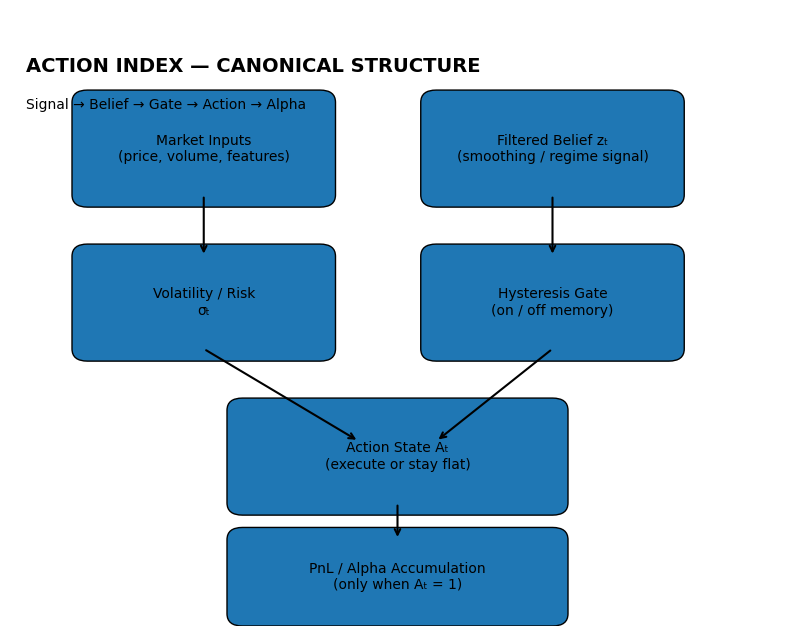

Action Index (Signal)

A scalar summarizing coherency / alignment. A readiness singal.

Alpha is not predicted. It emerges as a byproduct of controlled exposure.

Alpha is the integral of disciplined action under uncertainty.

Control architecture. Infers when the market is in a stable, exploitable regime, and only allows exposure during those windows.

What the system measures

Transforms raw observations into belief about states. Belief has uncertainty. That uncertainty evolves.

State Evolution

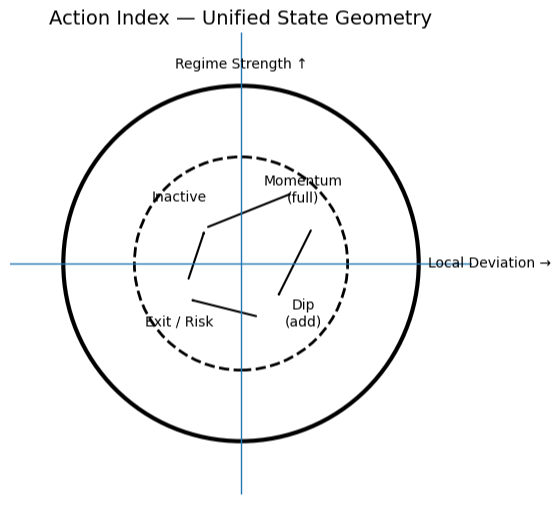

The circle is a dynamical phase variable. It captures whether the system is inert, accumulating, absorbing stress, or releasing momentum.

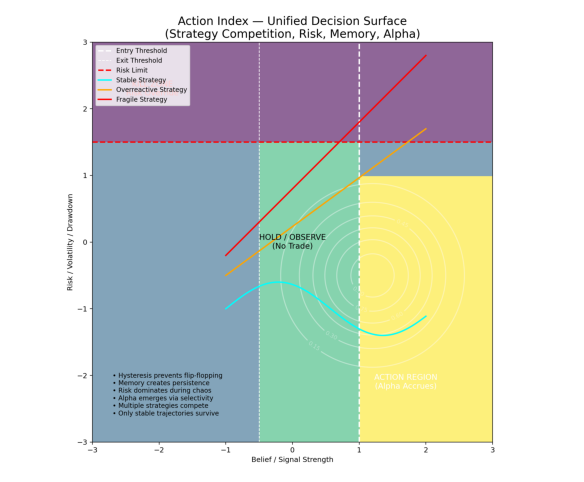

Action Index converts noisy price dynamics into low-dimensional state geometry, where decisions arise from transitions between regime - deviation states rather than forecasts, allowing alpha extraction under uncertainty.

The system runs at multiple time constants.

Slow loop -> regime memory, low pass filter

Fast loop -> fluctuations, derivative

Threshold -> decision boundary, hysteresis

The score does not fire instantly. It circulates. That circulation represents uncertainty being resolved.

State space of strategy. Operates on a state space where momentum defines when to play and dips define where to enter.

Humans are poor at managing thresholds, hysteresis, and patience. This system externalizes those functions.

The Action Index is a control-layer abstraction that converts uncertainty into bounded action. It models market state geometrically, tracks belief and volatility dynamically, and uses hysteresis-controlled thresholds to regulate action. Rather than predicting outcomes, it manages exposure by enforcing stability, memory, and momentum constraints. Alpha emerges as the accumulated effect of disciplined action under uncertainty, rather than forecast accuracy. This removes human bias while preserving adaptivity.

The OverC (OVRC) Narrative

On Action

Most systems attempt to predict the future.

OverC does not.

It observes pressure accumulating in the present.

Action is not a forecast; it is a condition.

It emerges when forces align, and dissolves when they do not.

The Action Index is a measure of this alignment.

On Uncertainty

Uncertainty is not noise to be eliminated.

It is structure not yet resolved.

Markets, bodies, and decisions do not fail because they lack information,

but because they act without coherence between belief, momentum, and constraint.

OverC exists to preserve coherence.

On Control

Control is not force.

It is restraint.

A system that reacts to every signal oscillates.

A system that resists all signals stagnates.

OverC governs the space between these extremes.

It does not choose outcomes.

It regulates when choice becomes justified.

On the Action Index

The Action Index is a scalar summary of readiness.

It compresses many competing pressures into a single value that answers one question:

Is action warranted now?

This value rises when evidence aligns.

It decays when alignment dissolves.

It stabilizes when ambiguity dominates.

The index does not predict price.

It measures permission.

On Time

Time is not a sequence of moments.

It is a field of accumulation and release.

OverC treats time asymmetrically:

-

evidence accumulates slowly

-

conviction forms gradually

-

release happens quickly

-

decay is inevitable

This asymmetry is not a flaw.

It is the shape of adaptation.

On Strategy

Strategies are not rules.

They are hypotheses competing for relevance.

Each carries:

-

a memory of past effectiveness

-

a rate of decay

-

a contribution to the present state

OverC does not select the “best” strategy.

It lets strategies earn influence through consistency.

Weak strategies fade.

Strong ones persist — temporarily.

Nothing is permanent.

On Stability

Stability is not stillness.

Stability is the ability to absorb disturbance without losing orientation.

OverC enforces stability through:

-

thresholds

-

damping

-

decay

-

bounded response

Extreme events do not break the system.

They are absorbed, discounted, and contextualized.

Even three-sigma events are just information — not commands.

On Agency

The Action Index does not tell you what to believe.

It tells you when belief has become coherent enough to act.

This preserves human agency.

The system does not replace judgment;

it disciplines it.

On Use

OverC can sit above any domain:

markets, decisions, control loops, or strategy systems.

It does not compete with indicators.

It organizes them.

It does not replace models.

It governs their influence.

It does not predict the world.

It stabilizes interaction with it.

On Philosophy

All action is a wager against uncertainty.

The error is not in acting —

but in acting without structure.

OverC offers structure without rigidity,

discipline without dogma,

and control without illusion.

Final Principle

Action is not a choice.

It is a state that emerges when evidence coheres.

That state is measurable.

That measure is the Action Index.